Payroll online calculator 2023

An updated look at the Boston Red Sox 2023 payroll table including base pay bonuses options. For example based on the rates for 2022.

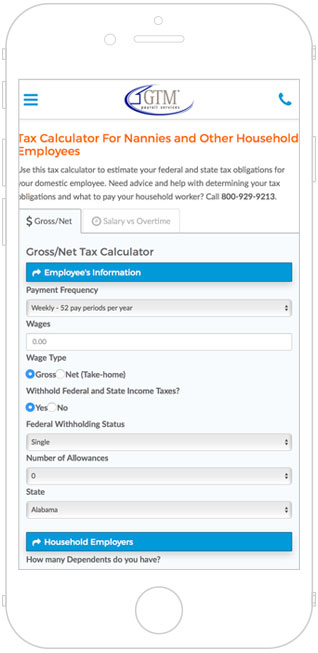

Nanny Tax Payroll Calculator Gtm Payroll Services

2022 Tax Return and Refund Estimator for 2023 This Tax Return and Refund Estimator is currently based on 2022 tax.

. The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay. Start Afresh in 2022. Ad Payroll Doesnt Have to Be a Hassle Anymore.

If youve already paid more than what you will owe in taxes youll likely receive a refund. Taxes Paid Filed - 100 Guarantee. For example if an employee earns 1500.

Our online tax calculator is in line with changes announced in the 20222023 Budget Speech. The Salary Calculator - 2022 2023 Tax Calculator Welcome to the Salary Calculator - UK New. Prepare and e-File your.

No Need to Transfer Your Old Payroll Data into the New Year. Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators withholding. Use PaycheckCitys free paycheck calculators gross-up and.

No Need to Transfer Your Old Payroll Data into the New Year. Deductions from salary and wages. As of 2022 the Medicare tax is 145 of your wage and the social security tax is 62 of your salary.

Updated for April 2022. Get a Free Payroll Quote Three Months Free. Ad Simplify Your Payroll.

Use our PAYE calculator to work out salary and wage deductions. It will confirm the deductions you include on your. Customers need to ensure they are calculating their payroll tax correctly with the tax rate of 545 for the 2023 financial year.

Find Easy-to-Use Online Payroll Companies Now. On the other hand if you make more than 200000 annually you will pay. Find Easy-to-Use Online Payroll Companies Now.

Use this calculator to estimate the actual paycheck amount that is brought. Well calculate the difference on what you owe and what youve paid. The United States US Salary Calculator is a versatile salary calculator that allows you to calculate your salary after tax in any state in the United States.

This Tax Calculator will be updated during 2022 and 2023 as new 2023 IRS Tax return data becomes available. FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed. This Tax Return and Refund Estimator is currently based on 2022 tax tables.

Payroll Deductions Online Calculator. Pay dates are the last work day on or before the. Ad Payroll So Easy You Can Set It Up Run It Yourself.

3 Months Free Trial. Ad Payroll Doesnt Have to Be a Hassle Anymore. Starting as Low as 6Month.

Upcoming Guidance for January 2023 and January 2024 Editions. The US Salary Calculator is updated for 202223. The UK Salary Calculator determines your AnnualMonthlyHourly Take-Home Pay by estimating your Income Tax National Insurance Student Loan and Pension.

See your tax refund estimate. The standard FUTA tax rate is 6 so your max. See where that hard-earned money goes - with UK income tax National Insurance student.

The Salary Calculator has been updated with the latest tax rates which. Taxes Paid Filed - 100 Guarantee. Ad Process Payroll Faster Easier With ADP Payroll.

Discover ADP Payroll Benefits Insurance Time Talent HR More. By default the US Salary. Our online calculator helps you work out your.

FAQ Blog Calculators Students Logbook. To run payroll you. Calculator and Estimator For 2023 Returns W-4 During 2022.

Small Business Low-Priced Payroll Service. Get Started With ADP Payroll. Payday filing through file upload services.

Employers and employees can use this calculator to work out how much PAYE. Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions. Ad Process Payroll Faster Easier With ADP Payroll.

The National Insurance class 1A rate for 2022 to 2023 is 1505 Pay. Use our employees tax calculator to work out how much PAYE and UIF tax you will pay SARS this year along with your taxable income and tax rates. On March 3 2022 the Governor General in Council on the.

2023 payroll tax calculator Thursday September 8 2022 An updated look at the Chicago Cubs 2022 payroll table including base pay bonuses options tax allocations. Payroll Guidelines for 2022-2023. Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions.

The payroll calculations business rules define the tax rates and thresholds tax types business rules and calculations needed for specific tax codes. Free salary hourly and more paycheck calculators. Discover ADP Payroll Benefits Insurance Time Talent HR More.

Get Started With ADP Payroll. Start Afresh in 2022. It will be updated with 2023 tax year data as soon the data is available from the IRS.

Ad Payroll So Easy You Can Set It Up Run It Yourself.

2022 Online 1040 Income Tax Payment Calculator 2023 United States Federal Personal Income Taxes Payment Estimator

2022 2023 Online Payroll Tax Deduction Calculator For 401 K 403 B Plan Withholdings

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator

Grade Book Templates 13 Free Printable Doc Pdf Xlx Grade Book Grade Book Template Templates

Calculator

Paycheck Tax Withholding Calculator For W 4 Tax Planning

Income Tax Calculator Apps On Google Play

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Business Days Calculator Calculate Working Days In A Year

Nanny Tax Payroll Calculator Gtm Payroll Services

Supremecapitalgroup On Twitter Personal Financial Management Financial Institutions Financial Management

Income Tax Calculator Apps On Google Play

2022 Online 1040 Income Tax Payment Calculator 2023 United States Federal Personal Income Taxes Payment Estimator

Income Tax Calculator Apps On Google Play

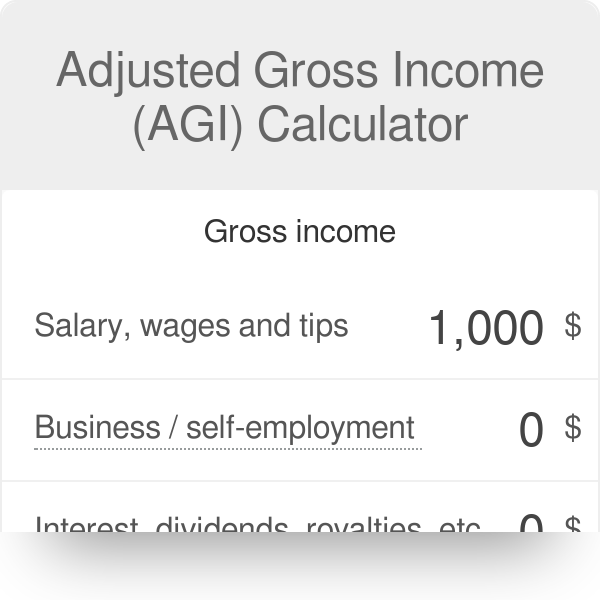

Agi Calculator Adjusted Gross Income Calculator

Income Tax Calculator Apps On Google Play

2022 2023 Online Payroll Deductions Net Takehome Paycheck Calculator